Understanding CAC Payback Period

How long does it take your company to profit off of each customer? If you sell physical goods, you’ve likely already worked out your profit margin per item. But unfortunately for SaaS businesses, it doesn’t work that way. Instead, it can take some time to actually earn back the money it took to acquire a customer.

Whether you should expect that wait to be just a few months or over a year can mean the difference between your company surviving or thriving. This is what the CAC Payback Period will tell you.

What Is the CAC Payback Period?

The CAC Payback Period measures the length of time it takes for you to earn back your customer acquisition costs (CAC). Generally, the smaller this number is, the better. However, it will depend on two important factors: the amount of money you spend to acquire each customer and the amount of monthly or yearly revenue you earn from each customer.

As anyone who has ever calculated their CAC knows, finding and acquiring new customers can be a significant expense. There is the cost of your marketing efforts and your advertising costs, as well as the salaries of your employees. You may even want to factor in the cost of property or equipment. It can all add up. The average CAC for the consumer fintech industry is $202. For enterprise fintech, new customers cost an average of $14,772.

Knowing your CAC Payback Period will give you some additional context around this number by measuring it against the amount of money you are earning from your customers. This will let you know how long your customers need to keep paying for your service – and help you decide what you need to do to keep them there.

How to Calculate CAC Payback Period

Knowing how to calculate your CAC Payback Period is straightforward, although it does involve gathering the following metrics beforehand:

Customer Acquisition Cost (CAC): The money spent on sales and marketing in order to acquire new customers.

New Recurring Revenue (MRR/ARR): The money new customers are bringing in during your preferred period (either monthly or annually).

Gross Margin: The percentage your Gross Profit makes up of your total revenue. Gross Profit is your revenue minus your Cost of Goods Sold (COGS).

First, let’s figure out your CAC. You can do this by tallying up any sales and marketing expenses incurred from acquiring new customers, then dividing that number by the total number of customers acquired in the period you are measuring. Here’s that formula:

Sales and Marketing Costs ÷ # of New Customers = CAC

Next, you’ll need to know either your New Monthly Recurring Revenue (New MRR) or New Annual Recurring Revenue (New ARR), depending on the period you’d like to measure. To find these, just multiply your average revenue per user (ARPU) by the total number of new users acquired within either a month or year:

ARPU x Total # of New Users = New MRR/ARR

Finally, you’ll need to find your Gross Margin. To do this, you’ll first need to find your Gross Profit by subtracting any direct expenses you took on while running your services (your COGS) from the revenue those services brought in. For SaaS companies, COGS typically comes from large expenses like hosting, licensing, and onboarding. Next, divide your Gross Profit by your revenue. Here is what that formula looks like:

(Revenue - COGS) ÷ Revenue = Gross Margin

Once you have these metrics in hand, you’re ready to calculate your CAC Payback Period. There are several ways to do it. Let’s start with the most simple, then move onto some variations.

CAC Payback Period for an Individual Customer

To begin, just take the amount of recurring revenue a customer is bringing in and multiply it by your Gross Margin, then divide the result by your CAC. Here’s the formula:

(Customer Revenue x Gross Margin) ÷ CAC = CAC Payback Period

For example, if they are paying you $100 per month, but your Gross Margin is 80%, then that gives you $80. If their CAC is $400, then that means it will take you five months to earn back the costs of acquiring that customer:

($100 x 80%) ÷ $400 = 5 months

By the sixth month, you should start seeing a profit. Of course, if they churn before the fifth month, then you will lose money.

CAC Payback Period for All New Customers

This variation allows you to see how long it will take for you to earn back your CAC for all new customers within a given period. It does this by taking the average CAC for a month or year, then dividing it by the average revenue per customer for that same period.

The formula for this will basically be the same as above, except you will use the New MRR/ARR metric we explained above. Here’s the formula:

(New MRR/ARR x Gross Margin) ÷ CAC = CAC Payback Period

So let’s say your ARPU was $50 and you brought on 10 new customers in the past month. This would give you an MRR of $500. Increasing the CAC to from $400 to $4,000 and then using the same Gross Margin as above (80%), this would give you a CAC Payback Period of 10 months:

($500 x 80%) ÷ $4,000 = 10 months

As before, this will mean you will break even at the 10 month mark and start earning profits after 11 months. But if any of these customers churn prematurely, you’ll have to recalculate.

CAC Payback Period for All New and Expanding Customers

As you’ve likely noticed, the two previous examples only calculated CAC Payback Periods for new customers. But this isn’t the only source of revenue for most businesses. You are also likely earning money from existing customer expansions. In order to factor in both new and expansion acquisition together, we’ll need to make two changes to our formula:

Use total sales and marketing expenses instead of CAC

Use Net New MRR/ARR instead of New MRR/ARR

Note: To find Net New MRR/ARR, simply add your Expansion MRR to your New MRR, then subtract any Churned MRR.

Here’s our new formula:

(Net New MRR/ARR x Gross Margin) ÷ Total Sales and Marketing Expenses = CAC Payback Period

Putting this all together, let’s say your Net New MRR was $30,000, your Gross Margin was 75%, and your total sales and marketing expenses were $100,000. This means it would take you about 4.5 months to break even:

($30,000 x 75%) ÷ $100,000 = 4.45 months

Importance of CAC Payback Period

CAC Payback Period keeps your business in check by helping measure the efficiency of your go-to-market efforts. For example, although you may be bringing in an impressive amount of new customer revenue each month, if the cost of acquiring all this new business is too high, you won’t be able to turn a profit for months – or even years. By tracking your CAC Payback Period, you can get ahead of this and start making adjustments.

Here are some other insights CAC Payback Period can give your business:

It Puts Churn in Context

Churn is typically shown in terms of dollar cost: the amount of revenue (both real and potential) lost when a customer cancels their contract. But what about the time it takes to recover this lost investment?

By recalculating your CAC Payback Period after losing a customer, you can see how much longer it will take to recover that initial investment. The more customers lost before their investment is recouped, the longer your payback period will become. This may point to more serious problems.

It Helps Identify Marketing Issues

A long CAC Payback Period may be a sign that you are overspending on marketing. And if it takes too long to earn back the money spent on acquiring a customer, then you put your company at greater risk of losing that investment from premature churn.

If this happens, take the opportunity to reassess where and how you are spending. If you are spending $1,000 on online ads that only convert a single $50 customer a month, it will take 20 months to earn back that investment. By eliminating this expense and looking for a more successful marketing channel, you can improve your CAC Payback Period significantly.

It Helps You Refine Your Pricing

A long CAC Payback Period can also be a sign that you haven’t priced your product correctly. If the price is too low, then it can take a long time to earn back your acquisition costs, putting you at greater risk of premature churn. Alternatively, if it is too high, you may not be attracting enough customers willing to pay the price.

Instead, set a goal for what you want your CAC Payback Period to be, then start introducing different pricing options to see what happens. By introducing tiered pricing, you may be able to attract a healthy mix of customers that give you the CAC Payback Period you need.

It Helps You Grow

By focusing on making improvements to your marketing, churn rate, and pricing structure, you can steadily start to improve your CAC Payback Period. As it shortens, you will be able to free up capital that you can then reinvest back into your company. This can put you at a significant competitive advantage.

For example, say both you and your competitor invest $20,000 each back into your business. If it takes them a year to earn this money back and you only six months, that means you are growing at a 50% faster rate than them – all without spending an extra dollar.

LTV:CAC Ratio

The LTV:CAC Ratio is another metric many businesses use to measure growth and analyze the effectiveness of their marketing and sales efforts. It divides the average LTV (lifetime value of a customer) by your acquisition cost, giving you an alternative way to see if your marketing is returning a profit. Here is the formula:

[(Revenue Per Customer – Expenses Per Customer) ÷ (1 – Customer Retention Rate)] ÷ (Direct Marketing Spending ÷ No. of Customers Acquired)

Calculating your LTV:CAC Ratio can be useful if you are a well-established company with plenty of data on things like churn, customer lifetime value, acquisition costs of customers per cohort.

But if you are a less established company, you likely won’t be able to accurately calculate the LTV of your customers. And even if you can, this LTV will most likely change as your business grows and evolves.

Instead, the CAC Payback Period is a much simpler and straightforward metric that can be calculated quickly, even when you’re an early-stage startup.

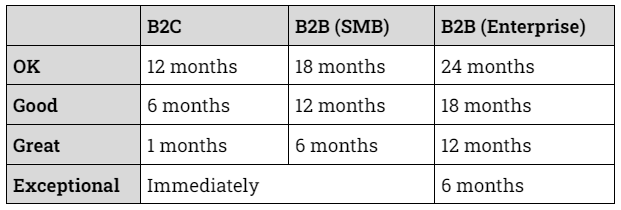

CAC Payback Period Benchmarks

In general, the shorter the payback period, the better. Of course, it is unlikely that any SaaS business will be able to earn back their acquisition costs immediately. So what is a good number to set as your goal?

The answer is that it will depend on the type of business. A company selling to consumers will typically have much lower prices and acquisition costs than one selling to enterprises. This will affect the length of their ideal payback period. This article contains a good summary of the range of what a good payback period can look like:

One thing to keep in mind is that a longer payback period is not always necessarily a bad thing. In fact, there are some cases in which it can actually be good. Consider the following scenarios:

You have a strong LTV. If you have a sticky product (i.e., one that attracts both new customers and is good at retaining them), then it may be worth having a longer payback period. This means you invest in customers and marketing strategies that may take a while to pay back because you can count on the money coming in.

You're a mature business. If you are a well-established business with a heavy cash flow and a diverse mix of loyal customers, then you can afford a longer payback period. This will allow you to extend contracts to customers that may not pay out for multiple years, but will burnish your brand.

You are focused on growth over profit. If you are more concerned about growing fast, then you may be comfortable with a longer payback period.

Frequently Asked Questions

What is the ideal CAC Payback Period for a SaaS startup?

There is no exact 'ideal' number since it depends on various factors like industry, business model, and growth stage. However, a shorter CAC Payback Period is generally better. Most investors and industry experts consider 12 months or less to be a good benchmark for SaaS startups.

How can I reduce my company's CAC Payback Period?

Reducing CAC Payback Period usually requires lowering the Customer Acquisition Cost, increasing Customer Lifetime Value, or both. You can achieve this by optimizing marketing and sales strategies, enhancing customer retention and satisfaction, and providing consistent value to customers.

Can a startup have negative CAC Payback Period?

A negative CAC Payback Period indicates that your company earns more revenue from a customer within a single billing cycle than the cost of acquiring them. Though it's a rare scenario, some businesses achieve this through viral growth or unique business models.